Chipmaker Nvidia’s income soared again in the last quarter as demand for its AI GPUs continues to outstrip supply. But the company warned of potential problems ahead due to tightening US export controls on China which are restricting its ability to do deals with clients in the far east.

Nvidia reported revenue of $18.1bn for the quarter to the end of October, representing a year-on-year increase of 206%. The company has been at the centre of the AI revolution, with its GPUs being used to train large language models such as OpenAI’s GPT-4. Its Q3 income this year eclipsed its entire revenue for 2021, signifying the speed of its growth.

CEO Jensen Huang said: “Our strong growth reflects the broad industry platform transition from general-purpose to accelerated computing and generative AI.”

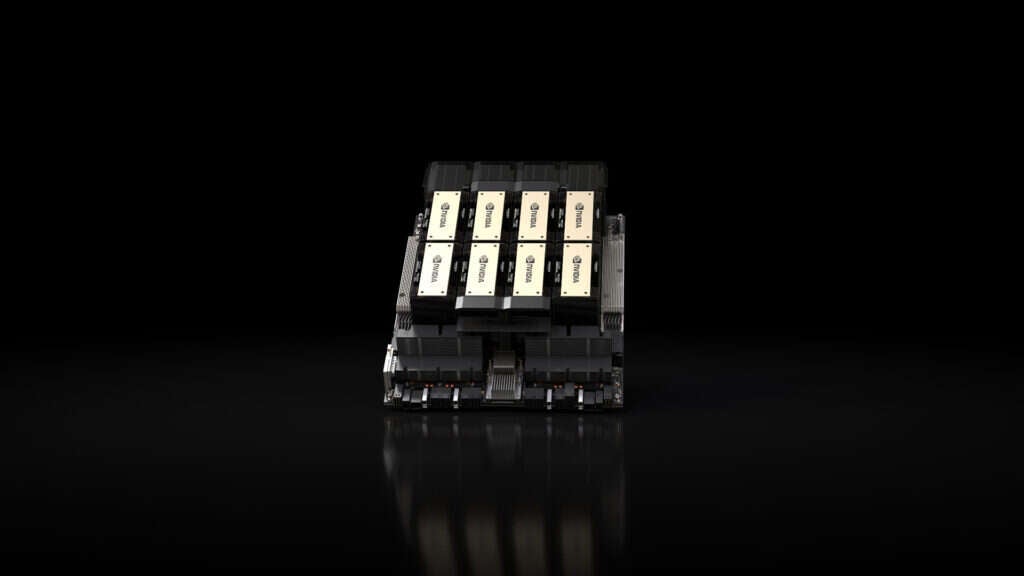

Nvidia’s blockbuster results built on data centre growth

Given the demand for AI chips, it’s no surprise that Nvidia’s data centre unit has driven its revenue growth, far outstripping the income from the company’s gaming division. Data centres delivered $14.51bn for Nvidia in the last quarter, compared to $2.86bn from gaming.

The Nvidia H100 GPU is the chip of choice for AI labs looking to train powerful AI models. The company expects to ship 550,000 of the processors this year, and last week revealed its successor, the H200, which will be available in the second quarter of next year and is said to offer 1.4 times more memory bandwidth and 1.8 times more memory capacity than the H100.

However, not all is rosy for the vendor, which is expecting further disruption from US sanctions on China. Washington has restricted the flow of chips and other components from US companies to the Chinese market, in a bid to hobble Beijing's AI capabilities. Nvidia has released a set of less powerful AI chips, the A800 and H800, to try and comply with the rules, but under changes announced in October these have been banned too. Controls have also been applied to some countries in the Middle East.

Nvidia CFO Colette Kress said: "We expect that our sales to these destinations will decline significantly in the fourth quarter of fiscal 2024, though we believe the decline will be more than offset by strong growth in other regions."

Nvidia faces increasing competition

As well disruption to its Chinese business, Nvidia also faces growing competition as other companies look to cash in on AI. Microsoft last week revealed its first ventures into silicon with two chips for its Azure cloud platform, including one specifically designed for AI workloads. The other cloud hyperscalers, AWS and Google Cloud, also have their own in-house chips for AI, while in the wider market vendors such as AMD are narrowing the gap with new silicon.

Content from our partners

Collaboration along the entire F&B supply chain can optimise and enhance business

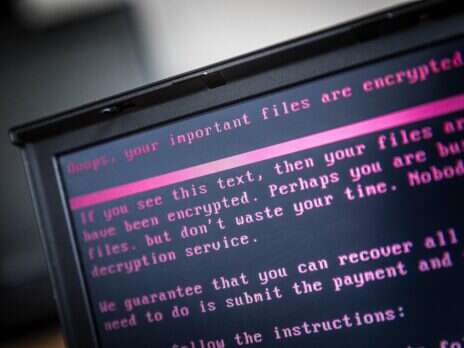

Inside ransomware’s hidden costs

The future of data-driven enterprises is transforming data centre requirements

There is "growing and intensifying competition in the semiconductor market," said Nigel Green founder of financial advisory company deVere Group. This "will threaten Nvidia’s market share and, therefore, margins over the longer term," Green believes.

View all newsletters Sign up to our newsletters Data, insights and analysis delivered to you By The Tech Monitor team

He added: "With China tightening regulations and cracking down on various industries, including technology, the company may face headwinds in this critical market.

"Regulatory uncertainties and geopolitical tensions could impact Nvidia’s ability to sustain its mighty results, especially if there are disruptions to its business operations in China."

Read more: